PATTERN ZAPPER PRO Advanced Technical Analysis Tool for Traders - Part 2 of 4

PATTERN ZAPPER PRO Advanced Technical Analysis Tool for Traders - Part 2 of 4

Theoretical Considerations for the Universal Pattern Zapper Pro Indicator

In this section, we will discuss some theoretical considerations related to the Pattern Zapper indicator. The goal is to create a universal indicator that combines ZigZags with various algorithms and automates the drawing of graphical tools, such as Pesavento Patterns and Fibo Levels, not limited to those two. To use the indicator, you simply need to input the quotes of the selected symbol, and the indicator will find the maximum and minimum market values using different ZigZags, anchoring various graphical tools onto the identified maximums and minimums.

The Pattern Zapper Part 2 contains ZigZags that are embedded within the indicator, while Parts 3 and 4 provide a more detailed description of the embedded graphical tools. The inspiration for the Pattern Zapper indicator is based on the ideas presented in the book, "Secrets of the Golden Section" by Sokolov, Yu.N. The book discusses the universal interaction structure of the universe and how it follows a cyclic pattern where time moves in a circle and changes are described with a wave curve.

The Golden Section, which is a universal constant of the interaction quantum, is also discussed in the book. The authors propose that there is a limit to the increasing of one force and the decreasing of another force and that this problem can be solved using the Golden Section. The Pattern Zapper indicator is built on the formulas presented in the book and aims to explore the nature of the Golden Section within the general cycle theory (GCT).

If you are interested in exploring the formulas for the Pattern Zapper indicator further, they are contained within the book mentioned above.

Description of ZigZags Embedded in the Pattern Zapper

The Pattern Zapper has many different parameters. The main parameter is the ExtIndicator. It chooses a ZigZag that will help to find the market extremums. The ExtIndicator number is set one after another as new ZigZags or modes are embedded into the Pattern Zapper. I would like to precondition that, whatever ZigZag is used, it is not recalculated on every tick. It is recalculated if:

the price falls outside the null bar (the market goes above the null bar's High level, below the null bar's Low level, or a new null bar appears); the earlier history is pumped; the terminal has been started at pumping of history that had appeared during the terminal was off. All ZigZag indicator styles are set using parameter ExtStyleZZ:

ExtStyleZZ = true - sets the ZigZag line styles using the COLORS tab (menu Charts->Indicators->Pattern Zapper->Properties->Colors); ExtStyleZZ = false - the ZigZag is shown as points at minimums and maximums. The First ZigZag ExtIndicator = 0 enables the standard ZigZag provided in the MetaTrader 4 Client Terminal before summer 2006. This ZigZag was slightly modified. The ideas for modifying were taken from the article published by Nikolay Kositsin: Multiple Null Bar Re-Count in Some Indicators. I also used my own solutions. Below are setup parameters for this ZigZag:

minBars corresponds with ExtDepth in the ZigZag provided within MetaTrader 4; ExtDeviation corresponds with ExtDeviation; ExtBackstep corresponds with ExtBackstep. The Second ZigZag ExtIndicator = 1 enables Automatic Channel ZigZag. Algorithm The average value of the first bar is calculated. Then the conditional average price of a bar is calculated. The trend direction in the next bar is detected by the shift of the bar conditional average price. The trend changes if the conditional average price deviates by a given value in points minSize or minPercent in percents. Parameters:

minSize -filtering by the amount of points, gives the amount of points; minPercent - percentage filter, gives the percentage, for example, 0.5. If you use percentage, set the desired value whereas minSize = 0.

The Third ZigZag ExtIndicator = 2 allows working with Ensign ZigZag. Ensign ZigZag is a conditional name. This version of the ZigZag was developed after I had observed the operating of the indicator underlying Pesavento Patterns built in Ensign. On the website of Ensign Softwar,e there was a short description of this indicator's building principles.

The algorithm of the indicator realized in Ensign can slightly differ from that realized in the Pattern Zapper. Algorithm. The first bar's minimum and maximum are compared to those of the follow-up bars. If a bar is found where the minimum and the maximum values are larger/smaller than those of the first bar, the trend direction is determined. If the minimum and maximum are larger than those of the first bar - it is the bullish trend. If they are smaller - it is the bearish trend. Then the algorithm for the bullish market (uptrend) is described. For the bearish trend (downtrend) - vice versa. The trend is determined as an uptrend. Store the bar maximum value in the hlast variable. If the next bar maximum value is above that of the preceding bar, the next bar will continue the bullish trend. Store the new value of the bar maximum hlast. If the maximums are equal, the trend is considered not to be changed. the trend remains bullish. Further workings of Pattern Zapper Pro such as DT mode, the Zigzags and Pattern algorithm are listed below.

Revamp your trading strategy with the powerful ZUP - ZigZag Universal with Pesavento Patterns indicator

Maximize your trading performance with ZUP - ZigZag Universal with Pesavento Patterns! Download our powerful indicator now and gain access to a range of advanced ZigZag algorithms and embedded graphical tools that can help you identify key market trends and entry/exit points with greater accuracy. With ZUP, you can customize your ZigZag settings and select the most suitable algorithm for your trading style. Plus, you'll receive regular updates and support to ensure that your trading stays ahead of the curve. Take your trading to the next level with ZUP - download now!"

DT Mode and ZigZag on RSI Indicator: An Overview

DT Mode refers to the Deeper Timeframe Mode, which is useful when it is difficult to find candlesticks on a smaller timeframe that correspond to the maximum or minimum of a larger timeframe candlestick. ZigZag breakpoints can be used to anchor tools like Pesavento Patterns and Andrews' Pitchfork. The article discusses the drawing of several ZigZags from different timeframes and the importance of attaching the ZUP indicators to the chart in the correct order. Additionally, the article highlights the limitations of the ExtIndicator = 9 mode, which is used to construct ZigZag on the RSI data. The mode is useful for demonstrating Pesavento Patterns and static Andrews' Pitchfork in the chart, but it has certain limitations, such as displaying only one indicator and not precisely defining the levels of 100% and 0%. The article concludes by discussing the active scanning mode used to search for Gartley Patterns, which can be processor-intensive and may cause the terminal to hang for a certain period of time.

DT Mode

There are situations where it's impossible to find candlesticks on a smaller timeframe that correspond to the maximum or minimum of a larger timeframe candlestick. In such cases, ZigZag breakpoints are based on the price values of the larger timeframe, resulting in a sequence of points that "hang in the air," including the ZigZag breakpoints. To anchor tools such as Pesavento Patterns and Andrews' Pitchfork, ZigZagHighLow can be used to choose the point to which the tools will be attached. If ZigZagHighLow is set to true, tools will be anchored to the minimums and maximums of bars on a smaller timeframe, while setting it to false anchors them to the ZigZag breakpoints, which are the minimums and maximums of bars on a larger timeframe.

To illustrate this concept, consider the example of drawing several ZigZags from different timeframes. Two ZUP_v60 with ExtIndicator = 6 are included in the chart, and the points' color and diameter can be selected in the COLORS tab, with the number being 5. The first indicator has a Grossperiod of 10080, and its points are colored red and have a diameter of 5. The ZigZag lines' color is maroon, which can be selected in the COLORS tab of the indicator parameters window, with the number being 0. The number of red points is 16, corresponding to the number of 4-hour candlesticks in a weekly candlestick. The second indicator has a GrossPeriod of 1440, and its points are colored dark green, with a diameter of 1. The ZigZag lines' color is Aqua, and the number of dark green candlesticks is 6, corresponding to the number of 1-hour candlesticks in a daily candlestick. To superimpose the results from different indicators, it's important to attach the ZUP indicators to the chart in the correct order. First, attach the indicator with red points, and then attach the one with dark green points. It's worth noting that if the chart's timeframe is changed from 4-hour to weekly, the indicator with dark green points won't be displayed since it uses data from the daily timeframe, which is smaller than the weekly timeframe. Similarly, when switching to a timeframe larger than daily, the daily timeframe data shouldn't be displayed.

It's also important to note that when working in the DT mode on timeframe GrossPeriod, the history depth must be greater than that of the working timeframe. Otherwise, ZigZag will be falsely drawn when it goes on a smaller timeframe into the deeper history than that of the GrossPeriod. Moreover, skipping of quotes on different timeframes can result in false ZigZag drawing. If the ZigZag has been falsely built, for instance, if two minimums and two maximums have been built one after another, the current timeframe and GrossPeriod quotes should be checked for any skipped bars. If there are skipped bars, it's necessary to remove the history of the corresponding timeframe from C:\Program Files\MetaTrader\history\xxx\ and reload the history. To make things clearer, all drawings within each timeframe can be made under one color scheme. In DT mode, the points for different timeframes can be of different, predefined colors.

ZigZag on RSI Indicator

The mode of ExtIndicator = 9 is utilized in a window under the chart containing RSI. To construct the ZigZag on the RSI data, a specialized version of ZUP called ZUP_RSI_v48 was created, which incorporates this mode. The ExtIndicator = 9 mode is solely utilized in ZUP_RSI_v48 and doesn't use the features available in version 49 and later versions. After version 48 has been added to the chart, it's necessary to change the timeframe for the system to begin drawing graphical tools. The ZigZag is drawn on RSI using a trend algorithm. The ZUP_RSI_v48 in the ExtIndicator = 9 mode was employed to demonstrate Pesavento Patterns and static Andrews' Pitchfork in the chart. The parameters used in the ExtIndicator = 9 mode include minBars, Price, and minPercent, where minBars is the averaging period to calculate the index for the RSI Period, Price is the selection of the price, on which the RSI will be drawn, and minPercent specifies the amount of "RSI indicator points" after which the new ZigZag ray will appear.

However, the ExtIndicator = 9 mode has some limitations. Only one indicator can be displayed, and the second and all subsequent indicator copies won't work correctly. The ZigZag's peaks and troughs will not coincide with those of RSI since the levels of 100% and 0% were not precisely defined. The ZigZag is shown within the full window height, and when the chart is rescaled, the ZigZag will be rescaled as well. The displaying of Andrews' Pitchfork for certain candlesticks is not corrected in this version, though it is not essential for this mode. All other ZUP tools work in this mode, including the bars counting on the ZigZag ray, which is fascinating for research. ZigZag with all its tools is displayed in a window below the chart and not in the chart window. There may be some defects in this version, and it is rather difficult to test the indicator for such a non-standard mode. This version is intended for experimentation.

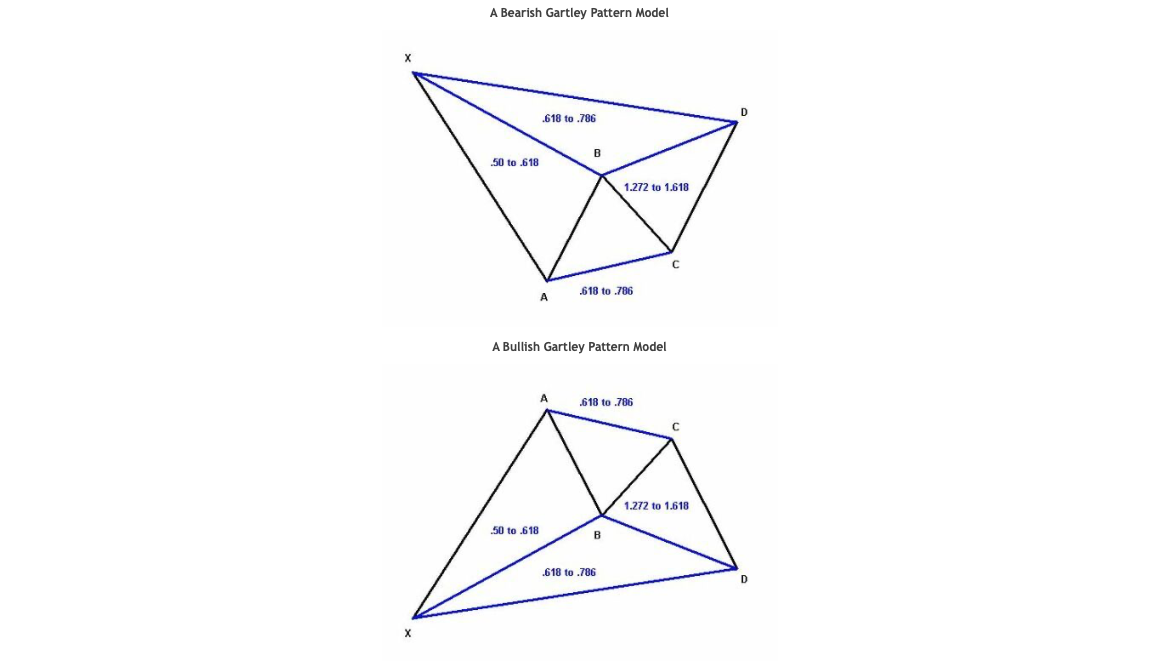

Search for Gartley Patterns

The active scanning mode used to search for Gartley Patterns is processor-intensive, and it may cause the terminal to hang for a certain period of time when the market moves intensively. The indicator uses parameters such as ExtGartleyOnOff, maxDepth, minDepth, DirectionOfSearchMaxMin, maxBarToD, ExtDeltaGartley, and ExtCD to enable the search for Gartley Patterns.

When searching for Gartley Patterns, active scanning searches in the minBars (Depth), and a ZigZag is built for each value of minBars (Depth), after which the Gartley Patterns are searched for on the ZigZag drawn. This operation repeats for the entire range of minBars (Depth) values from minDepth to maxDepth until a Gartley pattern is found.

If a pattern has been drawn for the selected mode, it will be found, and there will be no search in the ZigZag parameters. The maxDepth parameter sets the maximum value for the ZigZag's Depth parameter for active scanning to search for Gartley Patterns, while the minDepth parameter sets the minimum value of Depth to search for Gartley Patterns. The DirectionOfSearchMaxMin parameter sets the direction for searching in Depth, with false indicating searching from minDepth to maxDepth, and true indicating searching from maxDepth to minDepth.

Using the true setting is better as it allows larger Gartley patterns to be found first. The maxBarToD parameter sets the largest amount of bars from the null bar to the pattern's D point, which is important for trading as the D point should be on bars close to the null bar for the pattern found to retain its trading significance. The ExtDeltaGartley parameter sets the tolerance of price deviation from the recommended pattern retracement values, while the ExtCD parameter sets the value of the pattern's CD ray relative to the BC ray, after which the pattern analysis starts. The ExtColorPatterns parameter sets the color of the pattern's triangles.

When a pattern is found, a ZigZag with the corresponding parameters will be drawn, and the found pattern acts as if it calibrates the ZigZag with the found value. If no pattern is found, a ZigZag with the parameters minBars, ExtDeviation, and ExtBackstep as set in the ZUP will be built. It is possible to see the value of ExtIndicator, ZigZag parameters for the corresponding ExtIndicator, and the amount of bars to the D point in the names of triangles that color the patterns.

When a pattern is lost due to market movements, it can be rebuilt by switching to a smaller timeframe where more candlesticks are available for the ZigZag to catch the lost pattern. The butterfly is built using a "bulk" algorithm, which considers all permissible retracements in bulk, due to the uncertainty caused by the fact that the D point can be found using different retracements, such as the BD and the XD. When the butterfly is built using a "bulk" algorithm, a finer adjustment starts using Pesavento Patterns and dynamic/static Fibo tools to clarify trading conditions.

Conclusion

The article provides a concise overview of the concepts underlying ZUP, or ZigZag Universal with Pesavento Patterns, as well as the embedded ZigZags within the system. According to the author, the primary ZigZag drawing algorithms are implemented in ZUP, giving traders the freedom to choose their preferred algorithm. Additionally, all graphical tools included in the article will be automatically applied to the selected ZigZag, and it is possible that ZigZags based on different algorithms will be added in the future.

The article provides a link to download .zip files containing the ZUP_v60 and ZUP_RSI_v48 indicators, which have resolved some of the errors present in the initial version uploaded to the ONIX forum. However, the author notes that the indicator is relatively complex and may produce inaccurate results in certain market conditions. Drawing errors can occur due to errors in the code, issues with anchoring graphical tools to bars in MetaTrader 4, and changes in graphical tool characteristics when switching timeframes. To address this, the author proposes recalculating anchoring points for graphical tools to prevent erroneous constructions.

The author plans to describe the indicators and graphical tools embedded in ZUP in a subsequent article. While errors of the first type can be corrected, the author hopes to resolve errors of the second and third types with the assistance of the Client Terminal developers.

Download Pattern Zapper Part 1 for Free - Enhance Your Trading Strategy Today

Download Pattern Zapper Part 1 for free today and start taking your trading strategy to the next level! This powerful indicator combines ZigZags with various algorithms to automate the drawing of graphical tools, including Pesavento Patterns and Fibo Levels, making it a must-have for any serious trader. With Pattern Zapper Part 1, all you need to do is input the quotes of the selected symbol, and the indicator will do the rest, identifying maximum and minimum market values and anchoring various graphical tools onto them. Don't wait any longer, download Pattern Zapper Part 1 now and improve your trading performance.

List of References

Stakhov, A., Sluchenkova, A., Scherbakov I. Kod da Vinci i ryadi Fibonacci (Da Vinci Code and Fibonacci Series). St. Petersburg, Publishing House 'Piter', 2007.

Sokolov, Yu.N. Obschaya teoriya tsikla ili edinaya teoriya fizicheskikh vzaimodeystviy. Published by the North Caucasian State Technical University: Stavropol, 2003 (English version at http://www.ncstu.info/content/_docs/pdf/cycles/goldbook/06e.pdf).

Sokolov, Yu.N. Obschaya teoriya tsikla.

Hyerczyk, James A. Pattern, Price & Time: Using Gann Theory in Trading Systems. - John Wiley & Sons, Inc. 1998. 300 p.

Carney, Scott M. The Harmonic Trader. 1999. 305 p.

Pesavento, Larry. Fibonacci Ratios with Pattern Recognition. Edited by Steven Shapiro. - Traders Press Inc. 1997

Pesavento, Larry. Profitable Patterns for Stock Trading. - Traders Press Inc. 1999.