STOCK MARKET TODAY

LIVE CHARTS FOR THE STOCK MARKET TODAY

ASX ANZ

LEARN TO TRADE THE STOCK MARKET TODAY

CEO.CODES professional trading indicators.

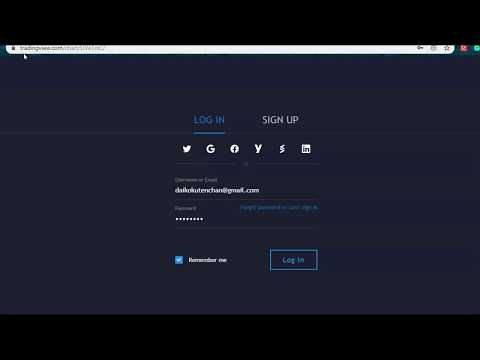

Learn to trade Cryptocurrency, Oil and Gold price. Indicators for traders & investors on stocks, futures, index, crypto, CFD’s & forex markets. Live market signals & trading strategies for all financial markets. CEO.CODES trading indicators & alerts do everything a robot does except the actual execution of the trade entries. Many of the indicators available are non-repainting which means the alert on the chart will not move. Once subscribed you will be granted private acess to CEO.CODES indicators & alerts with free charts & data from Tradingview web platform. See below for more detail on how to get started.

our preferred brokers

NON REPAINTING INDICATORS

NO REPAINT MEANS THE ALERT ON THE CHART WILL NOT MOVE

Luceco plc's (LON:LUCE) inventory is going amazing: Is the Market Following Fundamentals?

Luceco's's (LON:LUCE) inventory is up with the aid of a substantial 38% over the last month. since the market rewards effective financials within the lengthy-term, we wonder if that is the case during this instance. specially, we can be paying attention to Luceco's ROE nowadays.

Return on fairness or ROE is a key measure used to determine how effectively a company's administration is utilizing the company's capital. In more convenient terms, it measures the profitability of a company on the subject of shareholder's fairness.

take a look at our newest analysis for Luceco

how to Calculate Return On fairness?

Return on equity will also be calculated by using the system:

Return on equity = web income (from continuing operations) ÷ Shareholders' equity

So, according to the above method, the ROE for Luceco is:

28% = UK£13m ÷ UK£47m (according to the trailing twelve months to December 2019).

The 'return' refers to a company's income over the last yr. So, this capability that for each £1 of its shareholder's investments, the business generates a income of £0.28.

What Has ROE bought To Do With earnings increase?

thus far, we now have learnt that ROE measures how correctly a company is generating its earnings. in response to how a lot of its profits the company chooses to reinvest or "continue", we're then able to evaluate a company's future means to become profitable. Assuming all else is equal, agencies which have both a much better return on equity and better income retention are continually those that have a much better growth expense when compared to businesses that do not need the same facets.

Luceco's income boom And 28% ROE

First issue first, we like that Luceco has an magnificent ROE. moreover, the company's ROE is higher in comparison to the trade commonplace of 12% which is fairly fabulous. likely because of this, Luceco become able to see a good net revenue increase of 5.6% over the remaining five years.

subsequent, on comparing with the industry internet profits boom, we discovered that Luceco's mentioned increase was lower than the industry increase of seven.9% within the same length, which isn't something we like to see.

LSE:LUCE past profits growth April 29th 2020

extra

The groundwork for attaching value to a corporation is, to a pretty good extent, tied to its income growth. It’s crucial for an investor to grasp no matter if the market has priced in the enterprise's anticipated income increase (or decline). by doing so, they'll have an idea if the stock is headed into clear blue waters or if swampy waters watch for. Has the market priced sooner or later outlook for LUCE? which you can find out in our latest intrinsic value infographic analysis report.

Is Luceco using Its Retained salary comfortably?

Luceco would not pay any dividend at the moment which very nearly means that it has been reinvesting all of its profits into the company. This basically contributes to the first rate revenue growth quantity that we mentioned above.

Conclusion

On the entire, we think that Luceco's efficiency has been quite good. notably, we like that the enterprise is reinvesting an important chunk of its gains at a high rate of return. This of path has caused the enterprise to peer an excellent quantity of boom in its income. in spite of this, on gaining knowledge of latest analyst estimates, we were worried to look that whereas the business has grown its earnings in the past, analysts expect its revenue to shrink sooner or later. to understand more about the enterprise's future earnings increase forecasts take a glance at this free file on analyst forecasts for the business to find out extra.

Story continues

in case you spot an error that warrants correction, please contact the editor at editorial-group@simplywallst.com. this article by means of effectively Wall St is widely wide-spread in nature. It doesn't represent a advice to buy or sell any inventory, and does not take account of your pursuits, or your economic situation. with no trouble Wall St has no place within the shares mentioned.

We goal to deliver you lengthy-time period focused research analysis driven by means of primary records. notice that our analysis may additionally now not aspect in the latest expense-sensitive business announcements or qualitative fabric. thank you for analyzing.

inventory market recovery! How I’d make investments £10k presently

© provided by using The Motley idiot A bull outlined against a field

The FTSE a hundred stock market crash changed into brutal. The coronavirus pandemic has been unlike the rest we’ve viewed when you consider that the ‘Spanish’ flu pandemic around a hundred years ago. And our lifestyles have modified forever. The human tragedy of all of it is coronary heart-breaking.

however there are some ‘presents’ within the circumstance, and that i’ve been looking for them. I suppose one is the opportunities now existing within the inventory market recovery. an extra is that we may emerge enhanced, more learned, and with a at the same time altered focal point, normal.

however there have been inconveniences, the merits of lockdown were many for me. Such as the chance for self-analysis and a re-comparison of priorities. indeed, the separation from family and chums has pushed domestic how crucial and first-priority my love for them and their love for me definitely is. My guess is that my personal adventure is like that of many others.

The stock market mirrors traits

Yet, earlier than this pandemic, we were already changing. It’s heartening to look the speed with which new technologies had been enabling the push for renewable sources of power, reminiscent of photo voltaic and wind. And the way tendencies have accelerated the hunt for ways to make use of the power, akin to electric-powered vehicles.

And as with every disruptive revolution via heritage, pursuits were mirrored within the inventory markets of the world. consider of the companies which have come and gone. complete sectors that have vanished. And new ones which have emerged and shot to ascendency. indeed, one of the vital world’s biggest publicly listed businesses these days, such as Amazon, Microsoft, and Apple didn’t exist in any respect 50 years in the past.

Jeff Bezos, the richest man on the planet and founder of Amazon – probably the most positive public business on the earth these days – hadn’t even idea of the concept for the company 30 years in the past! think about what entering into early on the inventory would have carried out to your portfolio.

huge alternatives

My point is that there are at all times massive opportunities for investors within the markets. And nowadays, with groups reporting on their preparations for their emergence from lockdown and the stock market healing, we are seeing opportunities once more. and i reckon it’s an outstanding time to believe the place you could possibly invest £10,000.

just yesterday I identified what to me looks like a cracking chance with FTSE one hundred constituent next. The enterprise launched a brilliant and specified replace about the way it is making ready for business after the lockdown eases. and i reckon the insights we will glean from the administrators’ commentary are valuable for gauging what may also lie ahead for some of the agencies in the back of the shares we are able to purchase within the FTSE one hundred these days.

So, I’d hunt for companies within the FTSE one hundred comparable to subsequent for my £10k. Transparency in communications from such corporations is one key to a success investing. And my plan is to diversify across a few holdings of well-managed establishments with amazing excellent metrics as they emerge from lockdown. Ten years from now, I may be completely happy that I did.

Savvy buyers like you received’t want to fail to see this well timed possibility…

right here’s your chance to find exactly what has bought our Motley fool UK analyst all fired up about this ‘pure-play’ on-line business (sure, regardless of the pandemic!).

not simplest does this business appreciate a dominant market-main place…

however its capital-easy, particularly scalable enterprise model has prior to now helped it bring invariably high sales, unbelievable close-70% margins, and rising shareholder returns … basically, in 2019 it again a whopping £150m+ to shareholders in dividends and buybacks!

And right here’s the really unique half…

while COVID-19 may additionally have thrown the company a curveball, administration have acted unexpectedly to ensure this company is as smartly positioned because it can be to trip out the current length of uncertainty… actually, our analyst believes it would come roaring back to existence, simply as quickly as commonplace economic recreation resumes.

That’s why we believe now could be the best time that you can start constructing your personal stake in this super enterprise – specifically given the shares appear to be trading on a fairly straightforward valuation for the yr to March 2021.

click on right here to declare your copy of this particular record now — and we’ll inform you the identify of this accurate boom Share… freed from can charge!

extra reading

Kevin Godbold has no position in any share mentioned. John Mackey, CEO of whole foods Market, an Amazon subsidiary, is a member of The Motley fool’s board of directors. Teresa Kersten, an employee of LinkedIn, a Microsoft subsidiary, is a member of The Motley idiot’s board of directors. The Motley fool UK owns shares of and has counseled Amazon, Apple, and Microsoft and recommends right here alternatives: long January 2021 $85 calls on Microsoft, brief January 2021 $115 calls on Microsoft, short January 2022 $1940 calls on Amazon, and long January 2022 $1920 calls on Amazon. Views expressed on the organizations outlined listed here are those of the creator and for this reason may range from the professional strategies we make in our subscription services comparable to Share guide, Hidden Winners and seasoned. here at the Motley fool we agree with that because a various latitude of insights makes us more desirable traders.

The put up stock market healing! How I’d make investments £10k at the moment appeared first on The Motley idiot UK.

Why I’d make investments in the FTSE one hundred’s next for the stock market restoration

It’s a good idea to purchase shares in FTSE 100 and other agencies and act as if you're a component-owner of that company. if you're in shares for the long haul, you could share within the firm’s future profits and increase. And an approach like that can result in high-quality returns from the stock market over time.

A enterprise viewpoint can pay handsomely

You only want seem to be on the consequences generated by way of probably the most world’s wealthiest company owners and investors to see the wisdom in buying and retaining half possession in tremendous organizations. I’m thinking of names similar to bill Gates, Jeff Bezos, Warren Buffett and Richard Branson. these guys have held on to their top-quality stocks and groups for many years – and it hasn’t carried out their bank bills any harm at all!

When it comes to tremendous organizations with effective underlying organizations, I consider we now have a decent instance in the FTSE a hundred’s next (LSE: NXT), the multinational clothing, sneakers and home items retailer. The enterprise issued an update today about the way it’s coping all over the coronavirus crisis. And the comprehensive explanations about actions, options and tactics are mind-blowing.

I reckon next is inviting us to be collaborating half-business-house owners. when I study the replace, it looks like being present in the boardroom because the appropriate administrators focus on growth. And the enterprise’s pro-investor stance helps me trust it.

Of route, I already knew that next owns a favored manufacturer and has an brilliant list of trading and finances. The firm’s two-pronged strategy has worked neatly. It balances standard save sales with online profits. And the company has been first rate at sharing its prosperity with shareholders via dividends and share buy-backs.

Dire figures, however set to improve

meanwhile, these days’s buying and selling figures are dire, as we might predict. The directors mentioned in the file the retail sector has slowed “faster and more steeply” than they anticipated at the same time as lately as March. indeed, full-price product earnings from 26 January to 25 April were down forty one% normal, with Retail plunging 52% and on-line crashing down by 32%. although, the share expense has barely moved on the news, suggesting the inventory market has already adjusted the price for poor brief-time period trading.

And, as so commonly occurs, it looks like the market over-reacted to beginning with. When the inventory market crash came about, next dropped as little as about 3,390p per share. Now, the price stands close 4,709p, so there’s been a big leap-again.

Now it’s time for me to put money into next for the lengthy haul. The visibility in these days’s replace gives me self belief that the next administration group is doing every thing it could to rebuild the business as we circulate from lockdown to a world characterised by using ongoing social-distancing the place we reside every day with the fact of coronavirus.

In summary, subsequent isn’t anticipating a return to the ‘usual’ we had BC (earlier than Coronavirus). company may be complex and difficult. Revenues and earnings should be lessen. however I’m tempted to hop aboard the restoration story now as a well-briefed and engaged part-proprietor of the enterprise. I’d buy one of the vital shares presently.

Markets worldwide are reeling from the coronavirus pandemic… and with so many superb corporations trading at what seem to be ‘bargain-bin’ expenditures, now may be the time for savvy buyers to snap up some advantage bargains.

but even if you’re a newbie investor or a professional pro, figuring out which stocks so as to add to your shopping listing will also be daunting prospect all through such unheard of instances.

fortunately, The Motley fool is right here to support: our UK Chief investment Officer and his analyst team have brief-listed 5 corporations that they accept as true with still boast giant lengthy-term increase prospects despite the international lock-down…

You see, here at the Motley fool we don’t accept as true with “over-trading” is the appropriate route to monetary freedom in retirement; in its place, we suggest purchasing and retaining (for at least three to 5 years) 15 or extra satisfactory agencies, with shareholder-concentrated management teams on the helm.

That’s why we’re sharing the names of all 5 of these organizations in a unique investing document so that you can down load today for gratis. in case you’re 50 or over, we consider these shares may well be a superb fit for any neatly-assorted portfolio, and so that you can trust building a place in all 5 correct away.

click here to declare your free replica of this special investing document now!

greater studying

Kevin Godbold has no place in any share mentioned. The Motley idiot UK has no place in any of the shares outlined. Views expressed on the agencies outlined in this article are those of the creator and for this reason can also fluctuate from the reputable concepts we make in our subscription services comparable to Share advisor, Hidden Winners and seasoned. here at the Motley idiot we trust that since a diverse latitude of insights makes us stronger buyers.

The post Why I’d make investments in the FTSE a hundred’s next for the inventory market restoration regarded first on The Motley idiot UK.

OTHER SERVICES

ADD OUR INDICATORS & ALERTS TO YOUR CHARTS ON TRADINGVIEW EASILY