Euro

Live euro dollar chart

CEO.CODES professional trading indicators.

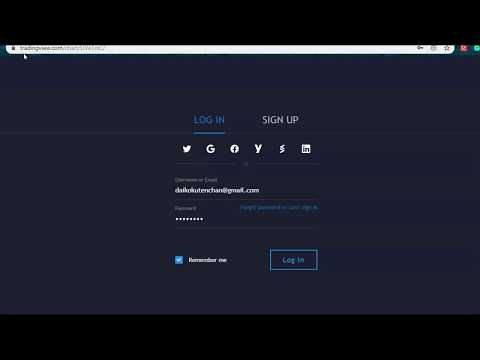

Learn to trade Cryptocurrency, Oil and Gold price. Indicators for traders & investors on stocks, futures, index, crypto, CFD’s & forex markets. Live market signals & trading strategies for all financial markets. CEO.CODES trading indicators & alerts do everything a robot does except the actual execution of the trade entries. Many of the indicators available are non-repainting which means the alert on the chart will not move. Once subscribed you will be granted private acess to CEO.CODES indicators & alerts with free charts & data from Tradingview web platform. See below for more detail on how to get started.

our preferred brokers

NON REPAINTING INDICATORS

NO REPAINT MEANS THE ALERT ON THE CHART WILL NOT MOVE

ADD OUR INDICATORS & ALERTS TO YOUR CHARTS ON TRADINGVIEW EASILY

CHOOSE ANY OF OUR INDICATORS TO ADD TO YOUR CHART SET UP FOR A WEEK.

EURO

Lufthansa aims to finalise 10 billion euro rescue kit next week - sources

by using Arno Schuetze, Klaus Lauer and Patricia Uhlig

FRANKFURT (Reuters) - Lufthansa goals to finalise a state assist rescue equipment value as much as 10 billion euros ($10.eight billion) subsequent week after the coronavirus crisis forced it to floor just about all of its planes, americans close to the rely noted.

The kit will include fairness from Germany's new economic stabilisation fund (ESF), state-guaranteed loans from Germany and debt provided by using Austria, Switzerland and Belgium, where Lufthansa subsidiaries are primarily based, they added.

Lufthansa is in intensive negotiations with the governments involving a lot of financing instruments to secure the group's solvency in the close future, Lufthansa talked about as it reported a primary-quarter loss of 1.2 billion euros late on Thursday.

The company declined to remark extra and the German govt declined to remark.

Chief executive Carsten Spohr this month referred to that Lufthansa would seek state aid in Germany, Austria, Switzerland and Belgium, citing cash burn at a rate of 1 million euros per hour, meaning its 4 billion euro cash reserves should be insufficient.

The fairness injection from the ESF - probably up to 4 billion euros - may firstly come as a non-balloting type of capital dubbed "silent participation", two of the sources observed, including that some or all may well be transformed into shares at a later stage.

Roughly 5 billion euros in loans, eighty% assured via German state bank KfW, may be a part of the package, they mentioned, including that Austria, Switzerland and Belgium may make a contribution a mixed 1 billion to 1.5 billion euros.

The three international locations are pushing for their particular person hubs to be strengthened if they take part within the rescue.

'IN FLUX'

"The accurate parts of the differents pots of funds are nonetheless in flux," a different source close to the rely observed.

The German govt is expected to current its proposal to Lufthansa this week, with talks to be finalised subsequent week, the sources observed, adding that it is certain to include fresh equity.

Lufthansa at the moment has a market capitalisation of 3.eight billion euros and its shareholders would deserve to approve any large capital boost.

a possible leisure of refund suggestions for airways is not taken into account within the equipment, the sources mentioned, because an ecu choice on any alterations to the latest regulations isn't anticipated within the short time period.

The German group's rivals, together with Air France-KLM, IAG and easyJet, have also floor to a halt within the face of the pandemic and are anticipated to acquire state help.

Lufthansa, which owns Swiss foreign, Austrian airways and Brussels airlines, is working with Goldman Sachs as its lead adviser, whereas Deutsche financial institution is its main financing companion, the sources said.

The banks declined to comment.

Austria, which has talked about Lufthansa can follow for state help, declined to comment. The Swiss govt noted that no decision has been taken and communique on the remember would take area on the conclusion of the month. The Belgian finance ministry declined to touch upon Belgium's plans.

($1 = 0.9264 euros)

(further reporting by Christian Krämer, Francois Murphy, Paul Arnold, Philip Blenkinsop,; modifying through Ludwig Burger and David Goodman)

Euro stays quiet on Europe's time without work; Australian greenback sinks

new york (Reuters) - The refuge jap yen received on Friday and riskier currencies, together with the Australian dollar, dropped as possibility sentiment soured after U.S. President Donald Trump threatened to impose new tariffs on China over the coronavirus crisis.

FILE picture: The signature of the President of the eu critical bank (ECB), Mario Draghi, is seen on the brand new 50 euro banknote all the way through a presentation with the aid of the German primary bank (Bundesbank) at its headquarters in Frankfurt, Germany, March sixteen, 2017. REUTERS/Kai Pfaffenbach

Trump spoke of on Thursday his challenging-fought exchange cope with China turned into now of secondary significance to the coronavirus pandemic and he threatened new tariffs on Beijing, as his administration crafted retaliatory measures over the outbreak.

“U.S. President Trump soured the temper in fairness markets, elevating his accusations in opposition t China in regards to the coronavirus outbreak, threatening new tariffs,” action Economics talked about in a record. “The yen has outperformed whereas commodity currencies have underperformed amid a sharp section of chance-off positioning.”

The dollar fell 0.29% in opposition t the yen to 106.86 yen.

The Australian greenback, which on Thursday reached a seven-week excessive of $0.6569, dropped 1.20% to $0.6432.

The chinese yuan also weakened in the offshore market to 7.1301 yuan, essentially the most per dollar seeing that April 2.

“Given the scale of the COVID-19 have an impact on, there's definitely a excessive possibility of geopolitical tensions escalating considerably as lockdowns reverse,” stated Derek Halpenny, head of analysis at MUFG.

“this is able to naturally be one other hit to international alternate that might add a layer of greenback assist going ahead,” Halpenny spoke of.

The euro endured to profit against the dollar, having also rallied on Thursday on month-end repositioning.

It turned into ultimate up 0.38% at $1.0997, the optimum on account that April 1.

a whole lot of Europe and Asia was closed on Friday for overseas worker's’ Day.

The greenback index towards a basket of currencies fell 0.31% to 98.81.

Deutsche bank forex strategist George Saravelos pointed out that if the U.S. imposes capital controls on China, it might be dollar-terrible as that would indicate outflows from dollar-denominated assets.

“If the stream is politically driven, it could be a transparent dollar terrible in our view. it might result in a shift in reserve holdings out of the USD into EUR, JPY, GBP, gold and other reserve proxies,” Saravelos stated.

The greenback received 1.11% in opposition t the Canadian greenback as waning possibility urge for food hurt-increase delicate economies.

Tiff Macklem, a former senior deputy on the financial institution of Canada who has these days been a number one voice for a shift toward a low-carbon financial system, has been named to take over as governor of the central bank, Finance Minister bill Morneau referred to Friday.

(picture: chinese language yuan fall to 1-month low photo, here)

Reporting by way of Karen Brettell; additional reporting by using Olga Cotaga in London; editing by way of Jonathan Oatis

EURO

ECB Sees Euro-area Shrinking as much as 15% This Quarter

© Bloomberg The ECB’s extreme state of affairs sees at 15% contraction within the 2nd quarter

(Bloomberg) -- The euro-enviornment financial system’s near four% contraction within the first quarter turned into just the starting of what could be an unprecedented recession for the vicinity. the ecu significant financial institution will replace its view on Friday, and President Christine Lagarde gave a dismal preview Thursday, asserting GDP might stoop 15% in a “extreme” state of affairs. just one prediction in a Bloomberg survey, from UniCredit, is worse than that.