Trade US dolar

Live US dolar chart

CEO.CODES professional trading indicators.

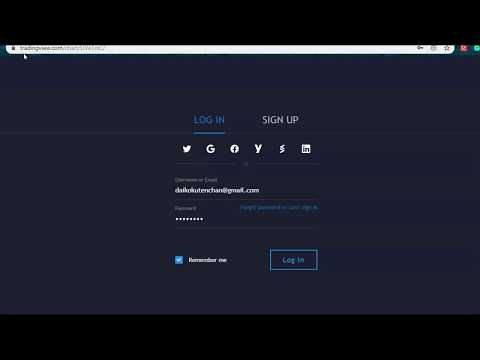

Learn to trade Cryptocurrency, Oil and Gold price. Indicators for traders & investors on stocks, futures, index, crypto, CFD’s & forex markets. Live market signals & trading strategies for all financial markets. CEO.CODES trading indicators & alerts do everything a robot does except the actual execution of the trade entries. Many of the indicators available are non-repainting which means the alert on the chart will not move. Once subscribed you will be granted private acess to CEO.CODES indicators & alerts with free charts & data from Tradingview web platform. See below for more detail on how to get started.

our preferred brokers

NON REPAINTING INDICATORS

NO REPAINT MEANS THE ALERT ON THE CHART WILL NOT MOVE

ADD OUR INDICATORS & ALERTS TO YOUR CHARTS ON TRADINGVIEW EASILY

CHOOSE ANY OF OUR INDICATORS TO ADD TO YOUR CHART SET UP FOR A WEEK.

DOLAR

Chinese language yuan falls on U.S. tariff probability, Australian dollar sinks

ny (Reuters) - The shelter eastern yen received on Friday and riskier currencies, including the Australian greenback, dropped as chance sentiment soured after U.S. President Donald Trump threatened to impose new tariffs on China over the coronavirus disaster.

FILE image: easy is solid on a U.S. one-hundred greenback bill subsequent to a jap 10,000 yen note in this photograph illustration shot February 28, 2013. REUTERS/Shohei Miyano/Illustration/File picture

Trump noted on Thursday his difficult-fought exchange take care of China become now of secondary value to the coronavirus pandemic and he threatened new tariffs on Beijing, as his administration crafted retaliatory measures over the outbreak.

“U.S. President Trump soured the mood in equity markets, raising his accusations towards China concerning the coronavirus outbreak, threatening new tariffs,” action Economics referred to in a document. “The yen has outperformed while commodity currencies have underperformed amid a pointy section of chance-off positioning.”

The greenback fell 0.29% in opposition t the yen JPY= to 106.86 yen.

The Australian dollar, which on Thursday reached a seven-week excessive of $0.6569, dropped 1.20% to $0.6432.

The chinese language yuan also weakened within the offshore market CNH= to 7.1301 yuan, essentially the most per greenback given that April 2.

“Given the size of the COVID-19 influence, there's certainly a high possibility of geopolitical tensions escalating significantly as lockdowns reverse,” referred to Derek Halpenny, head of research at MUFG.

“this is able to certainly be a different hit to world alternate that could add a layer of dollar help going ahead,” Halpenny noted.

The euro persevered to benefit against the dollar, having additionally rallied on Thursday on month-conclusion repositioning.

It turned into remaining up 0.38% at $1.0997, the optimum when you consider that April 1. EUR=

a good deal of Europe and Asia changed into closed on Friday for foreign employees’ Day.

The greenback index towards a basket of currencies =USD fell 0.31% to ninety eight.81.

Deutsche bank foreign money strategist George Saravelos said that if the USA imposes capital controls on China, it would be dollar-bad as that might suggest outflows from dollar-denominated assets.

“If the circulation is politically pushed, it might be a clear greenback poor in our view. it could result in a shift in reserve holdings out of the USD into EUR, JPY, GBP, gold and other reserve proxies,” Saravelos stated.

The dollar won 1.11% against the Canadian dollar CAD= as waning possibility appetite damage-boom sensitive economies.

Slideshow (3 images)

Tiff Macklem, a former senior deputy on the bank of Canada who has currently been a leading voice for a shift toward a low-carbon economic climate, has been named to take over as governor of the significant financial institution, Finance Minister bill Morneau spoke of Friday.

(image: chinese language yuan fall to 1-month low - here)

Reporting by Karen Brettell; further reporting through Olga Cotaga in London; modifying by way of Jonathan Oatis

Credit score market skilled Dan Zwirn says alternatives in retail, airways, and power debt are like 'choosing dollar expenses off the ground'

Longtime credit investor Dan Zwirn, at present the CEO of $1.three billion enviornment investors, laid out how the pandemic has created alternatives for buyers like himself in industries like aviation, energy, and retail.

Zwirn, who was compelled to shut his historical fund in 2008 after accounting irregularities, pointed out the existing crisis is "plenty greater" than 2008's economic cave in, as all industries have been affected.

still, opportunities in industries with precise assets, like airlines and power, are "obvious," he mentioned. "you might be deciding on dollar bills off the ground."

seek advice from company Insider's homepage for greater reports.

There are a lot of issues that are spectacular, in line with Dan Zwirn, the CEO of $1.three billion arena buyers and a longtime credit investor.

The "sheer extent" of all kinds of debt — company, subprime, municipal, and more — is impressive. The defaults that are coming for client loans for housing, automobiles, school, and greater is brilliant. And the alternatives for savvy traders to make cash off the disruption brought about by means of the radical coronavirus pandemic is stunning.

Zwirn, who's former, eponymous fund became shut down in 2008 because of accounting irregularities, is, in the instant future, concentrated on industries which have felt the affect of the pandemic most acutely. airlines, energy, and retail are all sectors that he singled out, and corporations in those sectors have tried to live on with stimulus funds from the government and poison-pill contracts with shareholders to offer protection to towards activist buyers.

"The big measurement of the interventions has at the least halted some issues," spoke of Zwirn in an interview with business Insider, "but these are areas which are definitely up a tree."

The credit markets have been roiled with the aid of the pandemic like the equity markets, as managers invested in securities reliant on individuals and businesses paying their rents faced margin calls and redemption requests that could had been complex to fulfill. large-name shops like Angelo Gordon, CQS, and Canyon partners were all hit complicated, but a source customary with arena's efficiency pointed out the firm's ideas were flat or a bit of wonderful for the yr.

In a recent letter to buyers, said initially by using Institutional Investor, Zwirn noted it be the premier probability to put money into aviation agencies on account that 2001. speakme with enterprise Insider, he mentioned that airways have been already in hindrance as passengers "needed to be packed in like sardines to make cash."

With the way forward for flight go back and forth uncertain, Zwirn believes funds will also be made by using financing purchases of airways' assets, like larger planes that can be became into cargo planes.

"The arbitrages may also be very brilliant," he noted.

offers like this can also be applied to industries like power and agents with a brick-and-mortar presence, he noted, and it doesn't deserve to be over-concept.

"These are only those which are completely glaring," he talked about. These industries have "real assets" which are able to be bought, and are in desperate want of cash.

"or not it's a machete decision, now not a scalpel decision ... you are choosing dollar bills off the floor."

ultimately, Zwirn expects to turn his attention to consumer debt, where he expects defaults and lenders unable to compile to turn into the norm.

"It won't be as absolutely centred as it become with mortgages," he mentioned, evaluating it to the 2008 financial crisis. Auto loans and student debt may be of selected interest as soon as records starts coming in on default rates.

And, compared to 2008, the pandemic may just be worse on the average grownup and their potential to repay, as smartly as the financial device at-colossal. in comparison to 2008, the existing pandemic has left banks with rather clear steadiness sheets, but put loads of the chance on the books of tougher-to-modify alternative investors, Zwirn pointed out.

This ability that in a crisis, which hit when activity fees had been already low, governments are restrained in their potential to bailout industries in trouble.

"It leaves you in a spot the place you cannot simply take over AIG and supply liquidity for 10 or 12 banks," he spoke of.

"It actually has the opportunity to be [worse than 2008], no question."

DOLAR

The us greenback is regarded a secure bet — even in these coronavirus days. here's why

the us now has the maximum variety of Covid-19 circumstances on the planet. You wouldn't consider that become the case searching on the foreign money market. —

whereas the brand new coronavirus has spread instantly across the U.S. and wreaked havoc in global markets, the U.S. greenback has been seen as a safe asset to invest in, at one element hovering four% on the U.S. dollar index — a basket of main currencies, specifically the euro, pound, yen, Canadian greenback, Swiss franc and Swedish krona.

or not it's now not simply skittish investors who are pilling into the greenback either. The U.S. dollar is stored with the aid of most global vital banks in reserves and a big share of overseas transactions are completed with the U.S. currency.

So what explains the greenback's durability?

basically the proven fact that the U.S. is regarded mostly politically and economically solid. Plus, the dollar's price isn't more likely to tremendously fluctuate the way, for example, the Turkish lira and Argentinian peso have in fresh years.

remaining yr, prior to the coronavirus pandemic, U.S. Treasury Secretary Steven Mnuchin boasted in regards to the U.S. dollar's affect.

"I take brilliant accountability that individuals use the dollar as the reserve forex of the world, and the greenback is quite amazing," Mnuchin mentioned. "The dollar is robust as a result of the U.S. economy and because individuals want to dangle greenbacks and the security of the U.S. greenback."

The respectable foreign money of the U.S. is essentially outdoor its borders, with more than $1.8 trillion of the dollar now in circulation everywhere. it be even believed that two-thirds of $a hundred expenses and essentially half of $50 bills are held outdoor the U.S.

In recent years, there had been calls for an choice reserve currency, ranging from nations like China to intergovernmental companies just like the United countries. Yet, for the foreseeable future, it's tough to imagine another currency gaining prominence over the U.S. dollar.