Coin Market Cap

Live coin market cap price chart

COIN MARKET CAP

Coin market cap is an a way to know the real value of cryptocurrency. It is the total circulating supply of the coins. The term market capitalization originally comes from the stock market. The term applies a little differently for stocks and crypto.

STOCK MARKET CAP VS CRYPTOCURRENCY MARKET CAP

In the stock market, the total value of all the shares is the market cap of the company. Owning a stock will give you partial ownership of the company and also partial return of the profits in dividends. The market cap is a reflection of the overall “value” of a particular stock.

CRYPTOCURRENCY VALUE

In cryptocurrency, the tokens are owned primarily by the company and the “whales” holding their coins. The market cap is reflected by this. The market cap in cryptocurrency is different to stocks as it does not reflect the true value of the company and coin. Making an accurate judgement of the value of a particular cryptocurrency needs further research to determine the true value and future of the coin. You may want to research some further information about the cryptocurrency like:

Is there a longer term use for the coin?

How passionate and active is the community about the product?

Are the coin coders experienced enough to see the project through ?

Does the coin have a successful marketing team?

Who is funding the ICO?

CEO.CODES professional trading indicators.

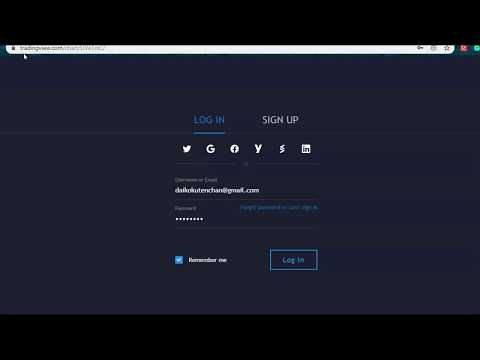

Learn to trade Cryptocurrency, Oil and Gold price. Indicators for traders & investors on stocks, futures, index, crypto, CFD’s & forex markets. Live market signals & trading strategies for all financial markets. CEO.CODES trading indicators & alerts do everything a robot does except the actual execution of the trade entries. Many of the indicators available are non-repainting which means the alert on the chart will not move. Once subscribed you will be granted private acess to CEO.CODES indicators & alerts with free charts & data from Tradingview web platform. See below for more detail on how to get started.

our preferred brokers

NON REPAINTING INDICATORS

NO REPAINT MEANS THE ALERT ON THE CHART WILL NOT MOVE

ADD OUR INDICATORS & ALERTS TO YOUR CHARTS ON TRADINGVIEW EASILY

CHOOSE ANY OF OUR INDICATORS TO ADD TO YOUR CHART SET UP FOR A WEEK.

ETH/USD: assignment capitalist named the coin that can overtake Ethereum from the second location

The cryptocurrency hyperlink may also boost by means of seven-hundred% in might also.

The challenge may also surpass Ethereum as the 2d-biggest coin by using the market capitalization.

Co-founder of Framework challenge Mike Anderson believes that the price of link token can also increase by 700% in can also and push Ethereum from the 2d vicinity within the international cryptocurrency score.

hyperlink is a local token at the back of the Chainlink project, focused on making a blockchain-based mostly cross-platform solution for at ease connection of smart contracts with the exterior statistics sources., comparable to data channels, APIs, etc. The assignment changed into launched in 2017, now its Ethereum-primarily based token sits on the thirteenth location within the global cryptocurrency rating with the current market price of $1.three billion.

Anderson is an early Chainlink investor. speaking recently with Cointelegraph, he mentioned that the price of the token can with no trouble exceed $25. He says that Chainlink is an coverage for the entire DeFi (Decentralized Finance) sector.

i might put it on par with about the measurement of Ethereum. and that i do not consider that it truly is an unreasonable approximation because the approach I see it, Chainlink is the insurance plan, the security mannequin for offering strong, respectable statistics feeds to your decentralized bar contract.

at the time of writing, hyperlink is altering arms at three.86$. The coin has received over four% in the contemporary 24 hours and elevated with the aid of 5% on a weekly basis. meanwhile, ETH/USD has settled at $210.00 after hitting $227.36 right through early Asian hours.

suggestions on these pages contains ahead-looking statements that contain hazards and uncertainties. Markets and contraptions profiled on this web page are for informational applications handiest and will no longer in any method come across as a advice to buy or sell in these assets. you should definitely do your own thorough analysis before making any investment choices. FXStreet does not in any way be sure that this counsel is free from mistakes, error, or material misstatements. It additionally does not make certain that this assistance is of a timely nature. Investing in Open Markets involves a very good deal of possibility, together with the loss of all or a portion of your funding, in addition to emotional distress. All risks, losses and costs associated with investing, together with total lack of most important, are your accountability. The views and opinions expressed in this article are these of the authors and don't always replicate the reliable coverage or place of FXStreet nor its advertisers.

Market Wrap: Bitcoin’s expense Tear Suggests It’s FOMO Time once more

There’s an historic saying on Wall street that economic markets are pushed by way of two feelings, fear and greed. in the crypto markets, the driving force is commonly a mix of both: fear of missing out.

The FOMO, as it’s commonly referred to as, appeared powerful Wednesday as bitcoin jumped to its optimum ranges in nearly two months, rising as excessive as $8,900 while a buoyant stock market shrugged off dangerous economic facts.

At press time, the area’s biggest cryptocurrency by way of market capitalization was up a watch-catching 14% over 24 hours at $eight,851, well above the 10-day and 50-day technical indicator moving averages, signaling intense bullish sentiment.

Crypto stakeholders proceed to speak up the upcoming halving, an adventure that happens as often as the Olympic video games or a U.S. presidential election, and for many bitcoiners is more critical than either.

around can also 12, the quantity of recent bitcoin mined every 10 minutes or so will drop by 50%, an everyday scheduled adjustment that turned into followed with the aid of price increases in 2012 and 2016. possibly in anticipation of history repeating, during the past 5 days bitcoin has logged 21% expense appreciation.

“The media insurance of the halving over the ultimate 5 months, mixed with normally increasing Google search extent for ‘bitcoin halving’, suggests that we may see an identical FOMO across the upcoming halving event,” talked about Danny Kim, head of salary for crypto liquidity issuer SFOX.

past any herd mentality, market contributors cited the ambiance nowadays is very diverse than throughout the first two halvings.

"This halving is taking region in a tons extra volatile, doubtful macroeconomic atmosphere than all previous routine,” observed Charles Cascarilla, CEO of stablecoin provider Paxos.

change outages

buying and selling exercise spiked Wednesday, pretty much overwhelming servers at U.S. cryptocurrency exchanges Coinbase and Kraken, which suffered short outages.

Coinbase leads major USD change extent in 2020 with three $200 million trading days in April.

The S&P 500 index climbed 2.6% in buying and selling Wednesday despite bad GDP numbers displaying the world’s biggest economic system contracted for the first time in six years.

shares’ ascent helps bitcoin but there’s likely a limit to the upside, referred to Josh Rager, a crypto dealer and founder of gaining knowledge of platform Blackroots.

“individually, I have no idea if bitcoin can hit $10,000 however I suppose as long as the inventory market performs neatly it's going to proceed to have a positive impact on bitcoin,” Rager stated.

March’s market bloodbath resulted in volatility within the S&P 500: Three suitable-20 listing low days and two excellent-20 listing high days in efficiency for the index that month.

however, April has been all about rebounding for the S&P 500 as executive stimulus measures abound. extra coronavirus aid is expected to be on the manner with U.S. first-quarter annualized GDP numbers down four.eight%, the primary quarter-to-quarter decline because 2014.

different markets

Digital assets on CoinDesk’s big board carried out neatly with bitcoin’s leap, and every thing is in the eco-friendly Wednesday. The 2d-greatest coin through market cap, ether (ETH), won 10% as of 21:00 UTC (5:00 p.m. EDT).

big-time winners consist of ethereum basic (and many others) up by means of 11%, eos (EOS) gaining 9% and bitcoin sv (BSV) climbing 6%. All fee alterations are as of 21:00 UTC (5:00 p.m. EDT).

Oil is seeing a cost rebound Wednesday, up 15% as of 21:00 UTC (5:00 p.m. EDT). Oil output is down and futures on the fossil gas headed higher, a positive construction after the commodity’s two-month bout of high volatility.

Gold traded up lower than a percent Wednesday and closed the new york trading session at $1,710.

The Federal Reserve on Wednesday pointed out it might hold benchmark U.S. interest fees near zero while pledging to continue buying property in an unbounded amount to support keep world markets functioning smoothly.

The important financial institution, led through Chairman Jerome Powell, noted it might preserve the goal range for its short-term lending rate at 0% to 0.25%, “until it is assured that the financial system has weathered contemporary events and is on track to obtain its highest employment and value-stability dreams.”

U.S. Treasury bonds were blended on the day. Yields, which flow within the opposite path as rate, had been down on the 2-12 months, within the red 8.6%.

Europe’s FTSE Eurotop one hundred index of biggest groups in Europe ended its buying and selling day in the eco-friendly, up 1.3% on nice news regarding a possible coronavirus clinical remedy.

In Asia, buying and selling in Japan was closed Wednesday for a local break. The Shanghai Composite and the Hong Kong cling Seng index had been both up lower than 1%.

Disclosure examine greater

The leader in blockchain information, CoinDesk is a media outlet that strives for the highest journalistic specifications and abides with the aid of a strict set of editorial guidelines. CoinDesk is an impartial operating subsidiary of Digital forex neighborhood, which invests in cryptocurrencies and blockchain startups.

ETH/USD: assignment capitalist named the coin that can overtake Ethereum from the second location

The cryptocurrency hyperlink may also boost by means of seven-hundred% in might also.

The challenge may also surpass Ethereum as the 2d-biggest coin by using the market capitalization.

Co-founder of Framework challenge Mike Anderson believes that the price of link token can also increase by 700% in can also and push Ethereum from the 2d vicinity within the international cryptocurrency score.

hyperlink is a local token at the back of the Chainlink project, focused on making a blockchain-based mostly cross-platform solution for at ease connection of smart contracts with the exterior statistics sources., comparable to data channels, APIs, etc. The assignment changed into launched in 2017, now its Ethereum-primarily based token sits on the thirteenth location within the global cryptocurrency rating with the current market price of $1.three billion.

Anderson is an early Chainlink investor. speaking recently with Cointelegraph, he mentioned that the price of the token can with no trouble exceed $25. He says that Chainlink is an coverage for the entire DeFi (Decentralized Finance) sector.

i might put it on par with about the measurement of Ethereum. and that i do not consider that it truly is an unreasonable approximation because the approach I see it, Chainlink is the insurance plan, the security mannequin for offering strong, respectable statistics feeds to your decentralized bar contract.

at the time of writing, hyperlink is altering arms at three.86$. The coin has received over four% in the contemporary 24 hours and elevated with the aid of 5% on a weekly basis. meanwhile, ETH/USD has settled at $210.00 after hitting $227.36 right through early Asian hours.

suggestions on these pages contains ahead-looking statements that contain hazards and uncertainties. Markets and contraptions profiled on this web page are for informational applications handiest and will no longer in any method come across as a advice to buy or sell in these assets. you should definitely do your own thorough analysis before making any investment choices. FXStreet does not in any way be sure that this counsel is free from mistakes, error, or material misstatements. It additionally does not make certain that this assistance is of a timely nature. Investing in Open Markets involves a very good deal of possibility, together with the loss of all or a portion of your funding, in addition to emotional distress. All risks, losses and costs associated with investing, together with total lack of most important, are your accountability. The views and opinions expressed in this article are these of the authors and don't always replicate the reliable coverage or place of FXStreet nor its advertisers.

Market Wrap: Bitcoin’s expense Tear Suggests It’s FOMO Time once more

There’s an historic saying on Wall street that economic markets are pushed by way of two feelings, fear and greed. in the crypto markets, the driving force is commonly a mix of both: fear of missing out.

The FOMO, as it’s commonly referred to as, appeared powerful Wednesday as bitcoin jumped to its optimum ranges in nearly two months, rising as excessive as $8,900 while a buoyant stock market shrugged off dangerous economic facts.

At press time, the area’s biggest cryptocurrency by way of market capitalization was up a watch-catching 14% over 24 hours at $eight,851, well above the 10-day and 50-day technical indicator moving averages, signaling intense bullish sentiment.

Crypto stakeholders proceed to speak up the upcoming halving, an adventure that happens as often as the Olympic video games or a U.S. presidential election, and for many bitcoiners is more critical than either.

around can also 12, the quantity of recent bitcoin mined every 10 minutes or so will drop by 50%, an everyday scheduled adjustment that turned into followed with the aid of price increases in 2012 and 2016. possibly in anticipation of history repeating, during the past 5 days bitcoin has logged 21% expense appreciation.

“The media insurance of the halving over the ultimate 5 months, mixed with normally increasing Google search extent for ‘bitcoin halving’, suggests that we may see an identical FOMO across the upcoming halving event,” talked about Danny Kim, head of salary for crypto liquidity issuer SFOX.

past any herd mentality, market contributors cited the ambiance nowadays is very diverse than throughout the first two halvings.

"This halving is taking region in a tons extra volatile, doubtful macroeconomic atmosphere than all previous routine,” observed Charles Cascarilla, CEO of stablecoin provider Paxos.

change outages

buying and selling exercise spiked Wednesday, pretty much overwhelming servers at U.S. cryptocurrency exchanges Coinbase and Kraken, which suffered short outages.

Coinbase leads major USD change extent in 2020 with three $200 million trading days in April.

The S&P 500 index climbed 2.6% in buying and selling Wednesday despite bad GDP numbers displaying the world’s biggest economic system contracted for the first time in six years.

shares’ ascent helps bitcoin but there’s likely a limit to the upside, referred to Josh Rager, a crypto dealer and founder of gaining knowledge of platform Blackroots.

“individually, I have no idea if bitcoin can hit $10,000 however I suppose as long as the inventory market performs neatly it's going to proceed to have a positive impact on bitcoin,” Rager stated.

March’s market bloodbath resulted in volatility within the S&P 500: Three suitable-20 listing low days and two excellent-20 listing high days in efficiency for the index that month.

however, April has been all about rebounding for the S&P 500 as executive stimulus measures abound. extra coronavirus aid is expected to be on the manner with U.S. first-quarter annualized GDP numbers down four.eight%, the primary quarter-to-quarter decline because 2014.

different markets

Digital assets on CoinDesk’s big board carried out neatly with bitcoin’s leap, and every thing is in the eco-friendly Wednesday. The 2d-greatest coin through market cap, ether (ETH), won 10% as of 21:00 UTC (5:00 p.m. EDT).

big-time winners consist of ethereum basic (and many others) up by means of 11%, eos (EOS) gaining 9% and bitcoin sv (BSV) climbing 6%. All fee alterations are as of 21:00 UTC (5:00 p.m. EDT).

Oil is seeing a cost rebound Wednesday, up 15% as of 21:00 UTC (5:00 p.m. EDT). Oil output is down and futures on the fossil gas headed higher, a positive construction after the commodity’s two-month bout of high volatility.

Gold traded up lower than a percent Wednesday and closed the new york trading session at $1,710.

The Federal Reserve on Wednesday pointed out it might hold benchmark U.S. interest fees near zero while pledging to continue buying property in an unbounded amount to support keep world markets functioning smoothly.

The important financial institution, led through Chairman Jerome Powell, noted it might preserve the goal range for its short-term lending rate at 0% to 0.25%, “until it is assured that the financial system has weathered contemporary events and is on track to obtain its highest employment and value-stability dreams.”

U.S. Treasury bonds were blended on the day. Yields, which flow within the opposite path as rate, had been down on the 2-12 months, within the red 8.6%.

Europe’s FTSE Eurotop one hundred index of biggest groups in Europe ended its buying and selling day in the eco-friendly, up 1.3% on nice news regarding a possible coronavirus clinical remedy.

In Asia, buying and selling in Japan was closed Wednesday for a local break. The Shanghai Composite and the Hong Kong cling Seng index had been both up lower than 1%.

Disclosure examine greater

The leader in blockchain information, CoinDesk is a media outlet that strives for the highest journalistic specifications and abides with the aid of a strict set of editorial guidelines. CoinDesk is an impartial operating subsidiary of Digital forex neighborhood, which invests in cryptocurrencies and blockchain startups.

Cryptocurrency market price jumps $35 billion in 24 hours led by way of a surge in bitcoin

Cryptocurrency prices surged on Thursday, led by means of a big jump in bitcoin.

The complete market capitalization or value of cryptocurrencies jumped $35.3 billion in 24 hours as of two.19 p.m. Singapore time, based on records from CoinMarketCap.com.

Bitcoin, which bills for many of that flow, turned into at $9,388.30 — or up 18.fifty seven% in the remaining 24 hours as of two.03 p.m. Singapore time, Coindesk information confirmed. it is the highest stage considering the fact that March 7.

Cryptocurrencies noticed two main bouts of promoting in March amid the broader plunge in equity markets. however they have got now recovered that floor.

business participants attribute this to 2 components — crucial bank fiscal coverage as well as an upcoming experience known as bitcoin halving.

essential valuable banks around the world have unveiled big stimulus applications to cushion the economic fallout from the coronavirus pandemic. they have got additionally signaled their willingness to do extra. This has been an element at the back of the fresh rise in inventory markets in past few days, and has filtered through to bitcoin and other cryptocurrencies.

"My experience is that standard markets aren't reflecting fact on the ground even though, however this is additionally the influence of the Fed in the U.S. being extremely clear that they'll do anything to make certain there is economic balance," Vijay Ayyar, head of enterprise development at cryptocurrency trade Luno, instructed CNBC. He became referring to the U.S. central financial institution that pledged to keep its benchmark interest expense close zero until the economic system recovers.

"We may well be seeing some huge cash flowing into equities and crypto as well, as a result of the brand new cash printing."

An adventure known as bitcoin "halving" is happening in may additionally and it be to do with a pre-programmed trade in part of bitcoin's underlying expertise called blockchain.

The bitcoin world works with so-known as "miners" with excessive-powered computers competing to solve complicated math problems to validate bitcoin transactions. Whoever wins that race receives rewarded in bitcoin.

at the moment, miners are rewarded 12.5 per block mined. The rewards are halved each few years to retain a lid on inflation. by way of may 2020, the reward per miner can be reduce in half once more, to 6.25 new bitcoin.

This just about reduces the provide of bitcoin coming onto the market. Halving is an experience that occurs every four years. old halving hobbies have preceded large cost increases in bitcoin.

"whereas part of this rebound may well be defined by means of a renewed 'chance-on' perspective of global investors, it's additionally clear that bulls had been brought on through the upcoming halving event and the expected appreciation in value in the wake of it," pointed out Matthew Dibb, co-founding father of Stack, a bitcoin index fund issuer.

"For those buying into bitcoin now, many see this as a chance to purchase BTC at cut price basement rates earlier than a value pop submit halving."

Cryptocurrency prices surged on Thursday, led by means of a big jump in bitcoin.

The complete market capitalization or value of cryptocurrencies jumped $35.3 billion in 24 hours as of two.19 p.m. Singapore time, based on records from CoinMarketCap.com.

Bitcoin, which bills for many of that flow, turned into at $9,388.30 — or up 18.fifty seven% in the remaining 24 hours as of two.03 p.m. Singapore time, Coindesk information confirmed. it is the highest stage considering the fact that March 7.

Cryptocurrencies noticed two main bouts of promoting in March amid the broader plunge in equity markets. however they have got now recovered that floor.

business participants attribute this to 2 components — crucial bank fiscal coverage as well as an upcoming experience known as bitcoin halving.

essential valuable banks around the world have unveiled big stimulus applications to cushion the economic fallout from the coronavirus pandemic. they have got additionally signaled their willingness to do extra. This has been an element at the back of the fresh rise in inventory markets in past few days, and has filtered through to bitcoin and other cryptocurrencies.

"My experience is that standard markets aren't reflecting fact on the ground even though, however this is additionally the influence of the Fed in the U.S. being extremely clear that they'll do anything to make certain there is economic balance," Vijay Ayyar, head of enterprise development at cryptocurrency trade Luno, instructed CNBC. He became referring to the U.S. central financial institution that pledged to keep its benchmark interest expense close zero until the economic system recovers.

"We may well be seeing some huge cash flowing into equities and crypto as well, as a result of the brand new cash printing."

An adventure known as bitcoin "halving" is happening in may additionally and it be to do with a pre-programmed trade in part of bitcoin's underlying expertise called blockchain.

The bitcoin world works with so-known as "miners" with excessive-powered computers competing to solve complicated math problems to validate bitcoin transactions. Whoever wins that race receives rewarded in bitcoin.

at the moment, miners are rewarded 12.5 per block mined. The rewards are halved each few years to retain a lid on inflation. by way of may 2020, the reward per miner can be reduce in half once more, to 6.25 new bitcoin.

This just about reduces the provide of bitcoin coming onto the market. Halving is an experience that occurs every four years. old halving hobbies have preceded large cost increases in bitcoin.

"whereas part of this rebound may well be defined by means of a renewed 'chance-on' perspective of global investors, it's additionally clear that bulls had been brought on through the upcoming halving event and the expected appreciation in value in the wake of it," pointed out Matthew Dibb, co-founding father of Stack, a bitcoin index fund issuer.

"For those buying into bitcoin now, many see this as a chance to purchase BTC at cut price basement rates earlier than a value pop submit halving."