Trade BTC

Live BTC price chart

CEO.CODES professional trading indicators.

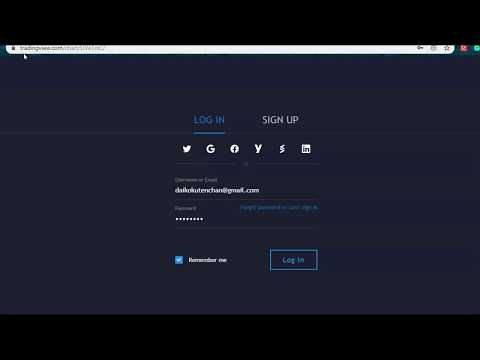

Learn to trade Cryptocurrency, Oil and Gold price. Indicators for traders & investors on stocks, futures, index, crypto, CFD’s & forex markets. Live market signals & trading strategies for all financial markets. CEO.CODES trading indicators & alerts do everything a robot does except the actual execution of the trade entries. Many of the indicators available are non-repainting which means the alert on the chart will not move. Once subscribed you will be granted private acess to CEO.CODES indicators & alerts with free charts & data from Tradingview web platform. See below for more detail on how to get started.

our preferred brokers

NON REPAINTING INDICATORS

NO REPAINT MEANS THE ALERT ON THE CHART WILL NOT MOVE

ADD OUR INDICATORS & ALERTS TO YOUR CHARTS ON TRADINGVIEW EASILY

CHOOSE ANY OF OUR INDICATORS TO ADD TO YOUR CHART SET UP FOR A WEEK.

Bitcoin cost analysis: BTC/USD aims lower back at $9,000 – Confluence Detector

BTC/USD has resumed the recuperation after a pointy sell-off.

The pivotal stage s created by using $9,000.

Bitcoin resumed the healing after a pointy sell-off on Thursday. the primary digital coin has gained over 3% considering the delivery of the day and settled above $8,900. A move in opposition t $9,000 is a clear opportunity now. the entire market capitalization of Bitcoin is $162 billion, whereas its normal daily buying and selling extent is $fifty three billion.

On the intraday chart, BTC/USD is relocating along the upside-looking 1-hour SMA50. This line serves as native guide (at present at $eight,770), whereas the typical trend is still bullish so long as the rate stays above this area. There are a number of technical obstacles each above and beneath the current price; although, how to the North looks greater seemingly at this stage. Let’s have a more in-depth seem and assist and resistance stages:

Resistance tiers

$9000 - sixty one.8% Fibo retracement each day$9,500 - the maximum degree of the old day$9,950 - Pivot factor 1-day Resistance 1

help tiers

$eight,700 – 23.6% Fibo retracement each day and monthly, the lowest stage of the old 4 hours$eight,250 – 38.2% Fibo retracement every day 1-hour SMA100 $eight,000 – day by day SMA100 and SMA200

BTC/USD, 1-day

suggestions on these pages incorporates forward-looking statements that involve risks and uncertainties. Markets and gadgets profiled on this web page are for informational purposes handiest and will no longer in any manner come across as a suggestion to purchase or sell in these assets. you should definitely do your own thorough research earlier than making any funding decisions. FXStreet doesn't in any method make sure that this information is free from errors, blunders, or fabric misstatements. It additionally does not make sure that this tips is of a well timed nature. Investing in Open Markets involves a superb deal of chance, including the lack of all or a portion of your funding, in addition to emotional misery. All hazards, losses and costs associated with investing, together with total lack of most important, are your responsibility. The views and opinions expressed in this article are these of the authors and don't always mirror the professional coverage or place of FXStreet nor its advertisers.

Bitcoin Unfazed by list earnings-Taking as BTC cost Resets for $9K

Thursday's Bitcoin (BTC) rate action changed into rather uneventful in comparison to the past forty eight-hours of activity that the most advantageous crypto on CoinMarketCap pulled off on Tuesday and Wednesday.

On crypto-Twitter, one will without problems find analysts calling for the digital asset to rally to $10,000 earlier than halving, and a number of have even hinted that a brand new lifetime excessive is on the cards.

Tether withdrawals start with BTC rate

despite these predictions, Bitcoin’s $1,seven hundred single day circulation made waves and crypto exchanges like Binance managed to deal with $sixteen billion in buying and selling extent, a brand new all-time excessive not considered because January 2018.

facts from on-chain analytics provider glassnode showed that USDT withdrawals additionally reached an all-time high of $1,943,417 shortly after Bitcoin fee topped out at $9,450.

Crypto market daily rate chart. source: Coin360

After reaching $9,450, the digital asset pulled returned eleven.36% to $8,394 before recovering to change in the $8,600 latitude for the remainder of the day. As mentioned in a old evaluation a pullback to retest former resistance levels became to be anticipated.

A retest of $9,000 returned in play

The start at $eight,383 also briefly touched the $8,300- $8,500 zone, which has functioned as a resistance and assist since last September 2019.

BTC USDT day by day chart. source: TradingView

on the time of writing, BTC/USD is making an attempt to push above the $8,600-$eight,800 zone where there's also a excessive extent node on the VPVR. A flow above this degree opens the door for a revisit to $9,200-$9,400.

BTC USDT each day chart. source: TradingView

If Bitcoin is unable to hang at $8,600 a drop to the sixty one.8% Fibonacci retracement is anticipated however a golden pocket start appears not likely on account that Wednesday’s day by day candle unexpectedly cut via multiple resistance degrees with out building the levels of help that are usually the outcome of consolidation phases.

hence, if Bitcoin doesn’t control a start off the sixty one.eight% Fib degree, a revisit to superior helps at $7,450 and $7,600 is extra more likely to take place.

BTC USDT four-hour chart. source: TradingView

at the moment, the fee is trying to set a 4-hour greater high above $eight,876 however buying extent is just a sliver and there is a endure cross on the relocating regular convergence divergence. On the hourly time body the MACD is curving up toward the signal line and the histogram is slowly working its manner toward 0. The four-hr RSI is also pushing again into bullish territory at sixty five.

in the intervening time, traders should hold an eye fixed on the 1-hour timeframe to look ahead to a rise in buy volume and 1 or four-hr candle shut above $eight,876.

The views and opinions expressed here are entirely those of the writer and don't necessarily mirror the views of Cointelegraph. every funding and trading movement includes possibility. be sure you behavior your own analysis when making a choice.

Bitcoin price analysis: BTC/USD rally to $9,500 presents a lot of buy alternatives – reckons analyst

Michael van de Poppe cautions towards following the herd, advises merchants to stay up for a retest in cost rallies.

Bitcoin price seat within the palms of the bulls regardless of a dip to $8,407; positive aspects above $9,000 are feasible.

Bitcoin fee sudden rally to $9,500 has cut up the neighborhood into two. One camp anticipates higher cost motion as we head against the halving. in spite of this, the second camp is, in keeping with Michael van de Poppe, a favored dealer, watching for a significant rate reversal. Michael believes that regardless of the rally, traders have a myriad of purchasing alternatives particularly after Bitcoin dipped to $8,407 earlier than recuperating to the current ranges at $eight,730.

Most individuals are “sitting in panic” according to the trader as an alternative of purchasing the dips within the wake of the FOMO-pushed surge. Michael, besides the fact that children, advised traders towards following the herd while mockingly praising folks that bought BTC at $9,four hundred.

by no means ever buy into that. there is always a retest and always a retrace going.

Bitcoin expense is trading at $eight,730 as outlined. This comes after a reversal from the dip at $eight,407. The biggest cryptocurrency continues to be largely within the arms of the bulls regardless of the correction. warning signs such as the RSI reveal a strongly bullish photograph. on the equal time, the bullish divergence from the MACD signals a likely brief-time period surge prone to carry BTC/USD into the stages above $9,000. other key support areas other than $eight,four hundred encompass the 200-day SMA at $eight,000, the ascending trendline and the 50-day SMA at $6,827.

BTC/USD every day chart