Bitcoin

Live Bitcoin price chart

CEO.CODES professional trading indicators.

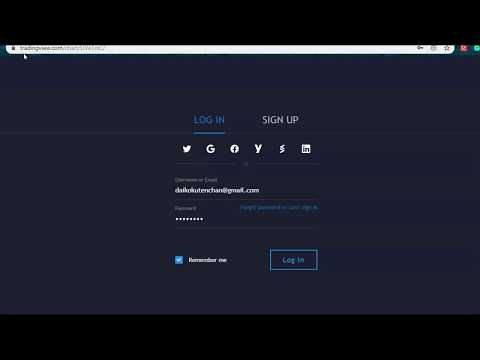

Learn to trade Cryptocurrency, Oil and Gold price. Indicators for traders & investors on stocks, futures, index, crypto, CFD’s & forex markets. Live market signals & trading strategies for all financial markets. CEO.CODES trading indicators & alerts do everything a robot does except the actual execution of the trade entries. Many of the indicators available are non-repainting which means the alert on the chart will not move. Once subscribed you will be granted private acess to CEO.CODES indicators & alerts with free charts & data from Tradingview web platform. See below for more detail on how to get started.

our preferred brokers

NON REPAINTING INDICATORS

NO REPAINT MEANS THE ALERT ON THE CHART WILL NOT MOVE

ADD OUR INDICATORS & ALERTS TO YOUR CHARTS ON TRADINGVIEW EASILY

CHOOSE ANY OF OUR INDICATORS TO ADD TO YOUR CHART SET UP FOR A WEEK.

Bitcoin’s Third Halving might be Its biggest test Yet

2018 S3studio

Bitcoin holders, builders, users, investors, and speculators are poised for the third Bitcoin Halving, which is simply days away. Slated for can also twelfth, the experience will reduce miner block rewards in half from 12.5 to 6.25 bitcoins, with new cash added to the network every 10 minutes. The annual inflation cost may be reduced from ~3.sixty four% to ~1.eight%, a superb milestone because it declines below the Fed’s inflation goal of two% per year.

youngsters the Halving has befell just twice in Bitcoin’s eleven-year life, historically the experience has been adopted by using a enormous upward thrust in rate of the dominant crypto asset. the first Halving came about in November 2012 and Bitcoin experienced rate appreciation of ~9,200% measured before the Halving to its cycle-high a yr after the event. in a similar way, the second Halving noticed Bitcoin respect ~2,900% to attain its all-time excessive of $20,000 eighteen months after the experience. despite the fact, it is unimaginable to derive statistically giant insights from two facts aspects, and Bitcoin is dealing with a very diverse macroeconomic ambiance this time around.

https://bitcoinblockhalf.com/

Two sides To the debate

coming into the Halving, analysts with opposing viewpoints occupy two leading camps. the first camp argues the event is already priced in; the second believes the Halving is not priced in and should ignite the subsequent bull market cycle. Proponents of the first cite the productive market hypothesis, whereas advocates of the 2nd factor to give/demand mechanics as well as the previous Halving market cycles.

This contemporary poll through Blockfolio indicates opinions are break up on even if the Halving is priced in or not. ... [+]

https://blockfolio.com/group/blockfolio/signal/DhsG1vq14l

in short, the efficient market hypothesis posits that each one information about publicly traded shares is already factored into the costs of those shares. since the Halving is publicly generic and has been for years, it could comply with that market contributors are expecting the event to be bullish, pushing the rate up in the months main as much as the adventure with a far better expected future cost discounted into the current.

Assuming the speculation is correct, when exactly turned into the experience priced in? At $10,000 in February, all over the crash under $four,000 in March, or now because it approaches $9,000? Bitcoin’s volatility demonstrates market contributors are unsure how to value the brand new asset and what its anticipated value may still be post-Halving. in its place, the hypothesis can be most fulfilling utilized to extra based asset classes, no longer a burgeoning one with little consensus for any valuation framework.

basic provide-demand economics dictates a discount in provide and constant demand would lead to a more robust fee. Demand for Bitcoin grows organically as individuals study its mechanics, community outcomes kick in, and new information surfaces exhibiting its resilience and performance as a save-of-value asset. as a result of its liquidity and ease of storage and transfer, a whole lending industry has these days emerged enabling retail and institutional buyers to use crypto as a type of collateral for loans. The crypto lending market has already handed $5 billion in personal loan originations in just two years.

Startups equivalent to Fold, Lolli, Pei, Donut, and others are offering Bitcoin rewards on purchases or money returned to accumulate crypto. As these items profit market share, greater charge networks and bank card companies will birth providing an identical products and capabilities. These apps naturally boost the number of Bitcoin holders and add ordinary buy power, slowly building up demand.

New industries, products, and use circumstances will improve for Bitcoin as the asset matures, so we can pressure significant demand.

Bitcoin Is Fueled by using Narratives

beginning as a speculative digital collectible, evolving to digital gold now, and doubtlessly remodeling into a global medium of alternate and foundational layer of digital capital markets in the future, Bitcoin good points credibility because it moves through a variety of tiers of maturity. on the time of the final two Halving hobbies, Bitcoin was an vague digital collectible buying and selling on unregulated exchanges with questionable safety practices. As world leaders now voice their opinions on crypto and main tech groups and banks scramble to difficulty their personal digital currencies, Bitcoin has turn into a family identify.

Federal Reserve Board Chairman Jerome Powell proclaims unlimited bond purchases in exceptional ... [+] movement to keep away from financial melancholy.

Getty images

The final two Halvings took place during the longest bull market in up to date history, spanning eleven years and all essential asset classes. This time is completely different. The coronavirus-precipitated lockdowns have set the stage for a deep international recession, as demand for items and services screeches to a halt. In response, the Fed introduced it is ready to buy unlimited quantities of treasury bonds and personal loan-backed securities. In other phrases: QE infinity.

The fresh equity bull market changed into the longest bull market on listing.

GFD Datastream, Goldman Sachs global funding analysis

To avoid a global financial meltdown in 2008, trillions of bucks have been injected into the economic system, beneficial criminally negligent and greedy conduct. concurrently, the seeds of a digital, provide-capped, immutable, censorship resistant, and non-sovereign shop-of-value asset begun to grow.

Bitcoin became constructed as a response to this fiscal and fiscal opulence. because the only monetary asset with a truly predictable and capped supply, Bitcoin has the properties of a safe haven asset that should serve as a hedge towards inflation, similar to gold. in order for it to satisfy its promise, Bitcoin must emerge post-crisis as a safe choice to currencies whose values are eroding instantly.

Bitcoin was born in the wake of the final financial disaster, and it might probably come of age in this one. on the equal time governments and principal banks juice their economies with newly minted cash, Bitcoin’s Halving will reduce new give in half. now is the time for Bitcoin to demonstrate if it is just one more computing device science experiment or a legitimate solution to our failing monetary equipment.

Bitcoin Rises again to $eight.8K at the same time as US stock Futures Drop

Bitcoin is up once again Friday as losses are seen in U.S. stock futures.

Following an increase of 23% over the final two days, though, the rally appears overstretched and the features can be short-lived.

At press time, the greatest cryptocurrency with the aid of market cost is buying and selling close $8,860, representing a 2.8 p.c gain on the day, in accordance with CoinDesk’s Bitcoin cost Index. fees have risen from lows near $8,600 considered previous today.

linked: American consumers Are Fueling Bitcoin’s Rally, facts Suggests

meanwhile, the futures tied to the S&P 500, Wall street’s fairness index, are down over 2 p.c.

Renewed boom considerations appear to be weighing on the futures market. Amazon, the area’s biggest online retailer, warned of a possible 2nd-quarter loss late Thursday, and Apple declined to provide a fiscal forecast for the primary time in a decade.

read extra: First Mover: Tezos Led Crypto Market With Twice Bitcoin’s positive factors in April

further, fears of clean U.S.-China alternate war gripped markets in Asia after President Trump threatened China with retaliatory tariffs over the coronavirus outbreak. Trump accused China of unleashing the virus into the realm due to some lousy mistake, and even cautioned the unlock could have been intentional.

related: First Mover: Tezos Led Crypto Market With Twice Bitcoin’s gains in April

All this reasonable gloom may, even though, bodes neatly for bitcoin, as some analysts believe bitcoin a secure haven like gold. That perception has been strengthened by the cryptocurrency’s stellar healing rally from the March 13 low of $three,867.

Bitcoin is additionally greatly anticipated to maintain its upward trajectory within the days main as much as the mining reward halving, due on may also 12.

Key on-chain metrics also suggest investor self assurance within the ongoing rally. both small and big investors, popularly known as “whales,” appear to be accumulating coins forward of the halving.

alternate balances declined to 2,357,741 BTC on Thursday to hit the lowest stage considering that may additionally 27, based on data supplied by using blockchain intelligence firm Glassnode. The metric, which suggests a holding mentality among traders, has dropped by means of over 10 % on account that March 13.

“basic, on-chain fundamentals are improving to pre-crash stages,” mentioned Glassnode in its weekly file.

while the percentages seem stacked in favor of better good points towards $10,000 within the short time period, the technical charts are signaling overbought circumstances and scope for cost pullback.

every day chart

Bitcoin shaped a bearish “pin bar” candle on Thursday, which includes an extended higher shadow and small purple physique with little or no lessen shadow. The pattern is indicative of rejection, or bull failure, at better costs.

The pin bar is additionally considered an early sign of bearish style reversal if it seems after a awesome price rally, as is the case right here.

Alongside that, the 14-day relative strength index (RSI) is reporting overbought situations with an above-70 studying.

read more: Bitcoin Whale Addresses Hit maximum quantity considering that August 2019

consequently, a drop to the 200-day standard at $8,000 could be viewed before a possible rally into 5 figures. “people have to be cautious of the expense pullback. Bitcoin might also revisit the $eight,000-$eight,500 for a long time, earlier than making one more attempt at $10,000 in the run-as much as the halving,” pointed out Chris Thomas, head of digital assets at Swissquote bank.

Thursday’s excessive of $9,485 is the stage to beat for the bulls. Chart analysts agree with a failed pin bar as an impressive bullish sign. So, if expenditures find acceptance above $9,485 on Friday, a higher rally to tiers above $10,000 may be considered.

Disclosure: The author holds no cryptocurrency at the time of writing.

US Bitcoin Holders be concerned About chinese language manage of the Mining network

may China take over the Bitcoin (BTC) ecosystem? It’s a extremely actual possibility, and it might ensue very right now because China controls more than half of the world’s Bitcoin mining operations — upward of 65% of the computing vigor to mine Bitcoin. No other nation is anyplace close that number. moreover, in response to Genesis Mining’s fresh “The State of Crypto Mining 2020” document, 60% of Bitcoin owners have a real situation about that chinese language majority and what it might imply for the stabilization of the cryptocurrency.

and that they should be worried. China owning more than half of mining operations could result in a disruption to the gadget, instability to the Bitcoin blockchain or perhaps a takeover of the total gadget. Bitcoin became no longer built to be a controlled foreign money.

So, why is China’s vast mining network a concern? with the intention to take note the advantage threat in China’s majority manage, we deserve to analyze a primary attribute of how the Bitcoin ecosystem works: decentralization.

Bitcoin works on a decentralized gadget

The founder of Bitcoin, Satoshi Nakamoto, had a vision for a forex that wouldn’t be field to a third celebration such as a bank, but that could be democratically exchanged from individual to particular person. The Bitcoin ecosystem works as a result of the neighborhood in the back of it: the miners who add blocks to the chain and the nodes that scan transactions to make sure they adhere to the Bitcoin protocol. There’s no one entity that governs Bitcoin — and that’s the factor.

however Bitcoin has a strongly decentralized community, it might still be threatened. If someone have been to manage over 50% of the energy used in mining operations, they could perhaps disrupt the complete device through what’s referred to as a fifty one% attack, or majority assault. A majority manage would allow the attacker to alter transactions, double spend Bitcoin for his or her personal benefit and even block other miners from mining.

Which is why it’s regarding that chinese mines are working sixty five% of the international hashing vigour used to mine Bitcoin. It’s definitely more than fifty one%.

Why China owns a huge element of computing vigor

It takes loads of power to mine Bitcoin, so it could make feel that miners would installation their rigs in places the place energy and labor charges are low priced. as a result of China is a middle of international change, lead instances and creation expenses for almost all goods are lessen than in different international locations, and this additionally holds actual for mining farms and miners. but while a couple of mining farms do run on sustainable elements equivalent to hydroelectric vigour, many rely on coal to gasoline their mining. whereas coal could be more cost-effective than different fuels equivalent to gas and oil, it’s still greater high priced than choice alternate options akin to hydroelectric and wind vigour, and it’s unsustainable and detrimental to the ambiance.

issues over manage

Having 65% of the realm’s mining determined in China is a concern. notwithstanding chinese language mines work independently, nearly all of the power is now determined in one nation. And the indisputable fact that the chinese language executive has handle over all of its industries is also a concern. If the govt decides that it desires to take over the Bitcoin ecosystem, it might leverage its vigor over the nation’s mining companies and easily take over a majority of the computing power, executing a fifty one% assault. , the decentralized gadget would be centralized beneath one country.

Uncertainty round China’s future in mining

while this could be a very true scenario if the entire appropriate pieces fell into area, it’s likely a long shot. New players in the mining market are more and more establishing shop within the European Nordic states, Canada and the united states. The running costs there, which encompass more affordable power options comparable to hydroelectric and wind vigour, together with an absence of govt oversight that might let organizations plan their suggestions freely make those areas pleasing for investors looking for a extra sustainable opportunity.

moreover, it’s unclear what China’s future should be with Bitcoin. It, together with all cryptocurrency, has been banned in the nation for years. though mining had been allowed to proceed, the trade as a whole became on the cutting block ultimate 12 months. even if the chinese govt introduced on the end of 2019 a commitment to setting up blockchain expertise and allowed mines to proceed to operate, the government nonetheless hasn’t reversed its ban on cryptocurrency. even if China could take over Bitcoin, it just may now not need to.

nevertheless, China’s overwhelming number of miners, mining pools and businesses is some thing the Bitcoin group needs to be aware about. on the identical time, the community can ensure that decentralization continues within the ecosystem by making certain it’s keeping its own mining operations varied. As i mentioned above, we’re seeing new mining farms cropping up in new geographies, in an effort to proceed to distribute supplies and mining vigor across the globe.

It’s yet to be considered what the future of chinese mining can be. but the Bitcoin community, which values transparency and democracy, will work to make sure that it continues to be open and purchasable to all.

The views, techniques and opinions expressed listed below are the creator’s on my own and do not always replicate or characterize the views and opinions of Cointelegraph.

Philip Salter is the top of mining operations at Genesis Mining, the realm’s greatest cloud crypto mining operation, the place he leads the application development, records engineering and analysis groups. Salter started his career as a application developer for BSI enterprise techniques Integration AG. Salter is an avid miner and crypto fanatic based in Germany.