A Guide to Using WaveTrader PRO for Successful Trading

Welcome to WaveTrader PRO, a PineScript Elliot Wave Algorythim Strategy designed to help traders identify potential trading opportunities based on automatic Elliot Wave analysis. This guide will walk you through the various features and settings available in the WaveTrader PRO and help you get started with using this powerful tool.

Installation and Set Up: To use the WaveTrader PRO, you will need to have access to TradingView and a PineScript editor. Once you have access, you can import the WaveTrader PRO code into your PineScript editor and compile the code. After that, you can apply the WaveTrader PRO to your chart and start using the various features and settings. If you don't already have a TradingView account, you can create one for free at TradingView. For help in adding PineScript code to your chart, you can read our step by step guide here.

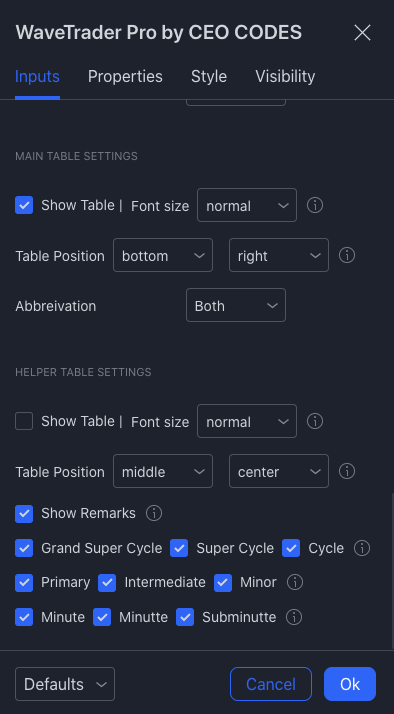

Main Table: The main table in the WaveTrader PRO provides traders with valuable information about the Elliot Wave count, including wave number, wave type, price range, and projected target. The table is color-coded to make it easier to read and interpret, and traders can adjust the font size of the table to their individual needs. Additionally, traders can customize the position of the table on the chart, moving it to the top, bottom, middle, left, or right of the chart.

Helper Table: The helper table in the WaveTrader PRO provides additional information to help traders with their analysis, including Fibonacci levels, pivot levels, and moving averages. Traders can choose to enable or disable the helper table, depending on their individual needs. Like the main table, the helper table can be customized in terms of font size and position on the chart.

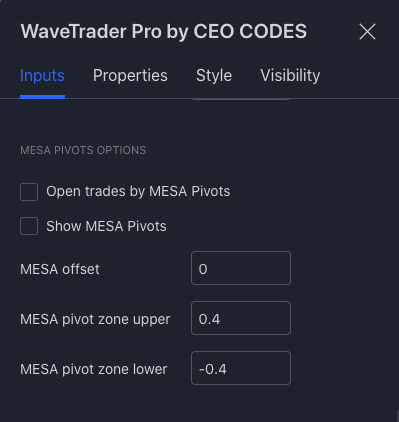

MESA Pivots: The WaveTrader PRO also includes optional benefits of MESA Pivots, which can be used to complement the Elliot Wave analysis. The MESA Pivots option comes with three settings: MESA offset, MESA pivot zone upper, and MESA pivot zone lower. These settings allow traders to customize the sensitivity of the pivots and identify potential support and resistance levels in the market.

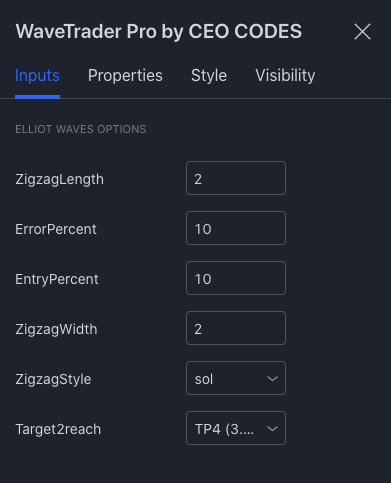

Settings: The WaveTrader PRO includes a range of customizable settings that allow traders to tailor the tool to their individual needs and preferences. Settings include ZigZag length, error percentage, entry percent, and target, among others.

Alerts: The WaveTrader PRO also includes alert functionality, allowing traders to set up notifications for specific market conditions or trading opportunities. Traders can choose to receive alerts via email, SMS, or in-app notification.

WaveTrader Pro : flexibility and customization through options

WaveTrader PRO is a popular trading tool that uses technical analysis to identify the Elliott Wave pattern in financial markets. This script has a number of benefits, including its ability to offer traders flexibility and customization through its options, including ZigZag Length, Error Percentage, Entry Percent, and Target.

ZigZag Length: The ZigZag Length option in WaveTrader PRO allows traders to set the minimum price movement required for a trend reversal. This means that traders can choose a ZigZag Length that best suits their trading style and the market they are trading in. For example, traders who prefer to trade on shorter time frames may choose a shorter ZigZag Length, while traders who prefer to trade on longer time frames may choose a longer ZigZag Length. The ZigZag Length option can also help traders to filter out noise in the market and identify more reliable trend reversals.

Error Percentage: The Error Percentage option in WaveTrader PRO allows traders to set the maximum error percentage that the script can tolerate in identifying an Elliott Wave pattern. This means that traders can choose a level of tolerance that best suits their trading style and the market they are trading in. For example, traders who prefer to trade with a higher level of accuracy may choose a lower Error Percentage, while traders who are more comfortable with some degree of error may choose a higher Error Percentage. The Error Percentage option can also help traders to avoid false signals and increase the reliability of their trades.

Entry Percent: The Entry Percent option in WaveTrader PRO allows traders to set the percentage of the target price at which they would like to enter a trade. This means that traders can enter a trade at a more favorable price, increasing their potential profit and reducing their risk. For example, if the target price for a trade is $100, a trader who sets the Entry Percent to 80% will enter the trade at $80. The Entry Percent option can also help traders to avoid entering trades too early or too late.

Target: The Target option in WaveTrader PRO allows traders to set a target price for their trades. This means that traders can set a profit target for their trades and close them automatically when the target price is reached. For example, if a trader sets the target price for a trade to $120, the trade will automatically close when the price reaches $120. The Target option can also help traders to avoid leaving profits on the table by closing their trades too early or too late.

Customize Your Trading Strategy with WaveTrader PRO's Elliot Wave Options

Utilizing WaveTrader PRO's cRSI Tools for Enhanced Trading Accuracy

WaveTrader PRO's cRSI (corrected Relative Strength Index) is a powerful tool that can help traders identify potential trading opportunities with greater accuracy. By using cRSI direction, traders can determine the direction of the trend and make informed trading decisions accordingly. cRSI pivots can help traders identify support and resistance levels, which are essential for identifying potential entry and exit points. By setting a cRSI EMA period, traders can adjust the sensitivity of the cRSI to better fit their trading style. These tools work together to provide traders with a comprehensive analysis of the market, helping them to make more informed and profitable trading decisions.

Gain a More Comprehensive Analysis of the Market with WaveTrader PRO's cRSI Option

BENEFITS of MESA PIVOTS

WaveTrader PRO has optional benefits of MESA Pivots offers traders several benefits. This strategy uses MESA Pivots to complement the Elliot Wave analysis, resulting in a more comprehensive and accurate trading approach. The MESA Pivots option comes with three settings: MESA offset, MESA pivot zone upper, and MESA pivot zone lower.

MESA offset: The MESA offset setting in Pine Script is a tool that allows traders to adjust the sensitivity of the MESA Pivots. It does this by shifting the position of the pivot line up or down, depending on the value set. The higher the offset value, the more sensitive the pivot line becomes, and the more pivots are generated. Conversely, the lower the offset value, the less sensitive the pivot line becomes, and fewer pivots are generated. Traders can use the MESA offset setting to customize the MESA Pivots to their trading style and the market conditions.

MESA pivot zone upper: The MESA pivot zone upper setting in Pine Script is a tool that allows traders to set the upper boundary for the MESA Pivots. It does this by creating a horizontal line at the upper boundary of the pivot zone. Traders can use the MESA pivot zone upper setting to identify potential resistance levels in the market and make more informed trading decisions. For example, if the price is approaching the upper boundary of the pivot zone, it could indicate that the market is becoming overbought, and a potential reversal could be on the horizon.

MESA pivot zone lower: The MESA pivot zone lower setting in Pine Script is a tool that allows traders to set the lower boundary for the MESA Pivots. It does this by creating a horizontal line at the lower boundary of the pivot zone. Traders can use the MESA pivot zone lower setting to identify potential support levels in the market and make more informed trading decisions. For example, if the price is approaching the lower boundary of the pivot zone, it could indicate that the market is becoming oversold, and a potential reversal could be on the horizon.

Gain an Edge in Trading with WaveTrader PRO's MESA Pivot Options

TABLE SETTINGS

The WaveTrader PRO is a powerful trading tool that offers traders a range of customizable settings to enhance their trading experience. One of the unique features of this tool is the ability to adjust the position of the main table and helper table. Traders can choose to move these tables to the top, bottom, middle, left, or right of the chart, depending on their individual needs and preferences. Additionally, the helper table can be disabled, allowing traders to focus solely on the main table. Another useful feature of the WaveTrader PRO is the ability to adjust the font size of the tables. This allows traders to use the tool on a range of devices, from mobile phones to desktop computers, without sacrificing readability. Traders can adjust the font size from tiny to huge, ensuring that they can read the tables comfortably and clearly, regardless of the device they are using. Overall, the customizable settings in the WaveTrader PRO make it a powerful and versatile trading tool that can be tailored to the individual needs of any trader.

Customize Your Trading Experience with WaveTrader PRO Table Settings

Whatever it is, the way you tell your story online can make all the difference.

Maximizing Trading Success with WaveTrader PRO's Customizable Tools and MESA Pivots

The WaveTrader PRO is a powerful trading tool that combines Elliot Wave analysis with customizable settings and optional MESA Pivots to help traders identify potential trading opportunities. By using the main table, helper table, MESA Pivots, and customizable settings, traders can gain valuable insights into the market and make more informed trading decisions. With the added benefit of alerts, traders can stay on top of the market and never miss a trading opportunity. Good luck!

DISCLAIMER: Please note that trading in financial markets involves significant risks, and past performance is not indicative of future results. The use of WaveTrader PRO does not guarantee profits or prevent losses in trading. It is the responsibility of the trader to understand the risks involved and to conduct their own analysis before making any trading decisions. WaveTrader PRO is a tool to assist with analysis and should not be solely relied upon for trading decisions.